Do You Own Appreciated Stock?

Your Stock Donation Can Maximize Gospel Impact While Reducing Taxes

Donating appreciated stock is a wise way to steward God’s provision, allowing more resources to support the training of pastors and the advancement of the gospel worldwide.

Why Donate Stock

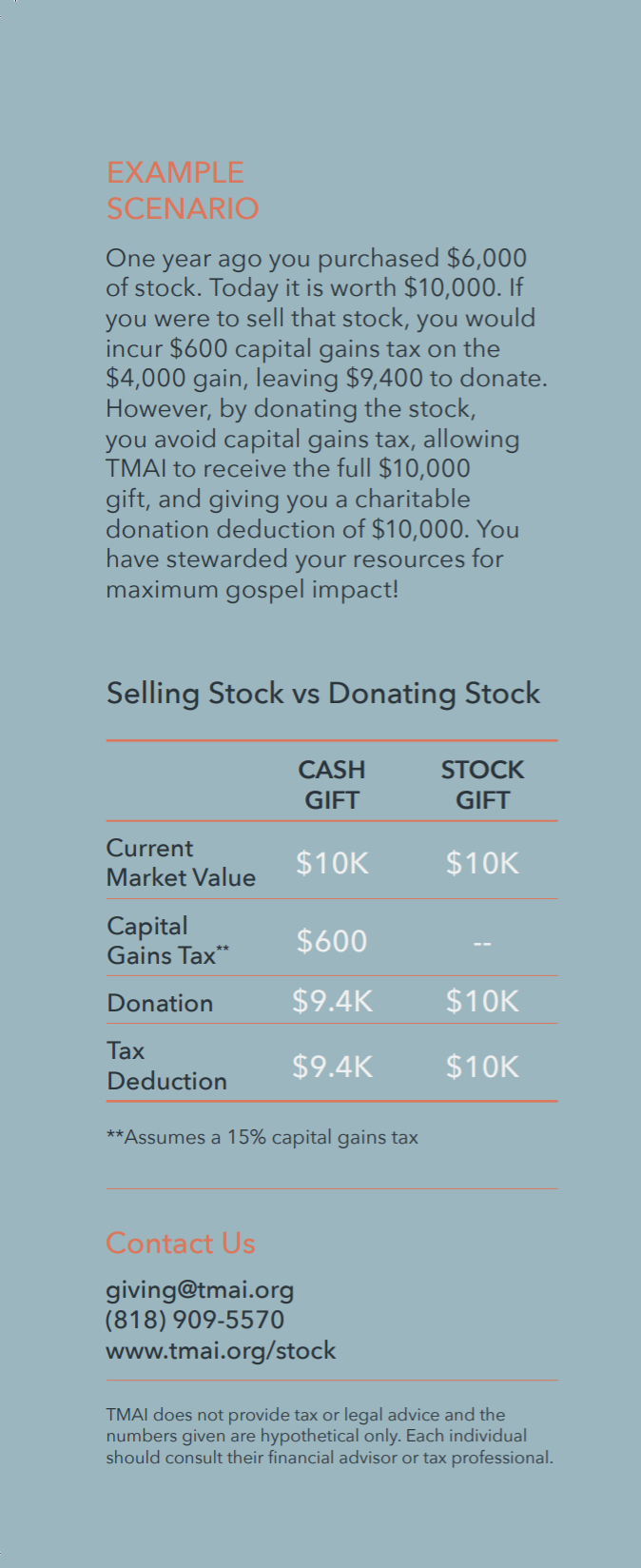

Donating appreciated stock to TMAI is a simple and tax-wise way to maximize your gospel impact. By giving stock, you can claim a charitable deduction for the full current market value and avoid paying capital gains tax. This allows you to give more - without increasing your out-of-pocket costs - so that more resources go directly toward training pastors and strengthening churches worldwide.

How Donating Stock Works

Transfer appreciated stock (owned for at least one year) to TMAI. Note: securities cannot be transferred from an IRA or retirement account.

Receive a charitable income tax deduction for the full fair-market value on the date of the transfer.

TMAI sells the stock and applies the proceeds where they are needed most, or to the school you designate.

How to Give Stocks

Contact your broker to initiate the stock transfer to TMAI.

Provide your broker with TMAI's information:

Brokerage: Charles Schwab

DTC Clearing 0164, Code 40

Account #: 3113-1740

Account Title: The Master’s Academy International

Or use our template letter to make the process simple.

Notify TMAI so we can confirm and document your gift:

Disclaimer: TMAI does not provide tax or legal advice. Please consult your financial advisor or tax professional to determine what is best for your situation.